Fraxlend is an over-collateralized, permissionless platform that creates lending markets between any two ERC-20 tokens with Chainlink feeds. Like Sushi’s Kashi, each pair is its own immutable and isolated market, which dramatically decreases cross-pool contagion risk.

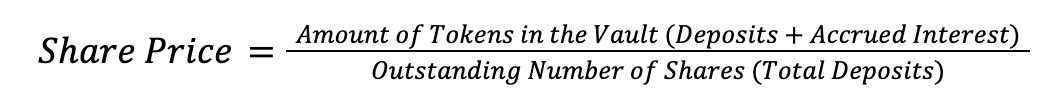

Lenders deposit tokens into the instantiated pair, and receive an equivalent ‘fToken’. The fToken is a yield-bearing asset that represents a pro-rata claim to assets in the pool. As interest accrues on the pool through borrowing activity, the Share Price of the fToken increases. Withdrawing assets from the pool redeems the fToken for a share of pool assets that is always equal-to-or-greater than the starting amount, as pools are both over-collateralized and accruing interest.

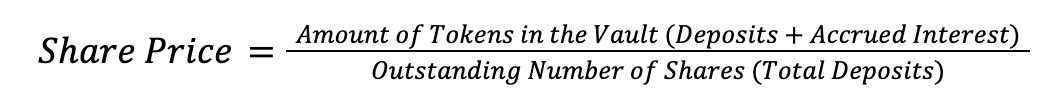

Borrowers provide collateral to pairs, and are able to take on debt up to a maximum Loan-to-Value amount set by the deployer (LTV). Borrowing assets from the pair carries interest, which is variable and based on the total utilization of lent assets in the pool.

The base isolated lending mechanisms of Fraxlend are battle-tested, but have some unique features that should help attract users.

For lenders, there are two primary concepts: fTokens and Vaults. Vaults are the core accounting mechanism for pairs, and track both the amount of assets in the pool, as well as the total outstanding claims to the pair.

Each fToken represents a number of ‘shares’ equivalent to the value of deposited assets. The exchange rate of fTokens for pair assets is variable, and based on the amount of interest accrued to the vault since deposit. That means that current Share Price can be calculated at any time by dividing the Amount of Tokens in the Vault (read: Market Cap of the pair) by the outstanding total number of Shares (read: Total Value of Lent Assets).

Borrowers have two major focus variables: LTV and Interest Rate. Each pool has a Maximum LTV of 75% for permissionless pairs that is immutable and set upon deployment. If the ratio of a borrower’s debt to their collateral rises above Maximum LTV, the position becomes unhealthy and can be liquidated.

Liquidated positions are repaid on the borrower’s behalf in exchange for an equal value of collateral, plus a liquidation fee that is immutable on deployment, and set to 10% by default. As debt accrues interest over time, borrows can become unhealthy, meaning potentially active management of positions, through addition of collateral or repayment of debt, is important.

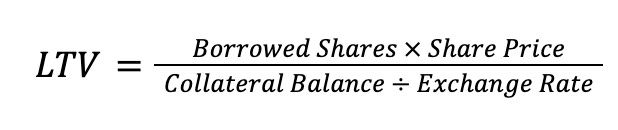

Interest Rate determines the rate that borrowers pay to take debt against their collateral. This rate is set on a pair-by-pair basis, and is immutable and fixed upon deployment. Fraxlend will launch with two rate options: the Linear Rate Calculator and the Time-Weighted Variable Rate Calculator.

The Linear Rate Calculator is the simpler of the two options, raising borrow interest rate linearly as pair utilization rises, and vice-versa.

The Minimum Rate, Vertex Rate, and Max Rates are the three variables for Fraxlend pools set on launch. Minimum Rate is the base interest rate at 0% pool utilization. Between the Minimum Rate and the Vertex Rate, interest rate increases linearly. The increase in slope of the interest rate line between the Vertex Rate (75% utilization, for default permissionless pools) and the Max Rate (100% utilization) to help ensure rates adjust in periods of high demand for pool debt.

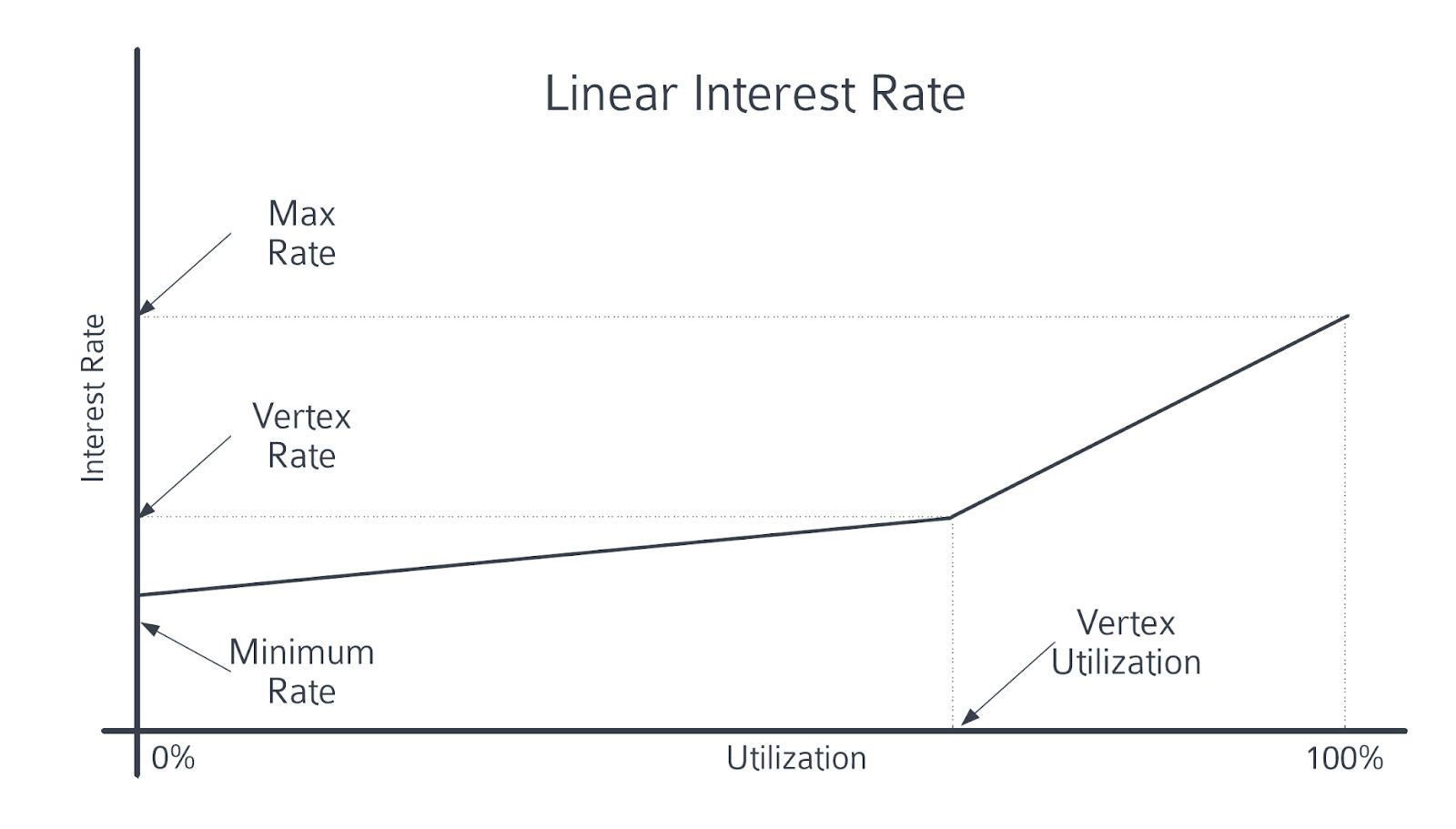

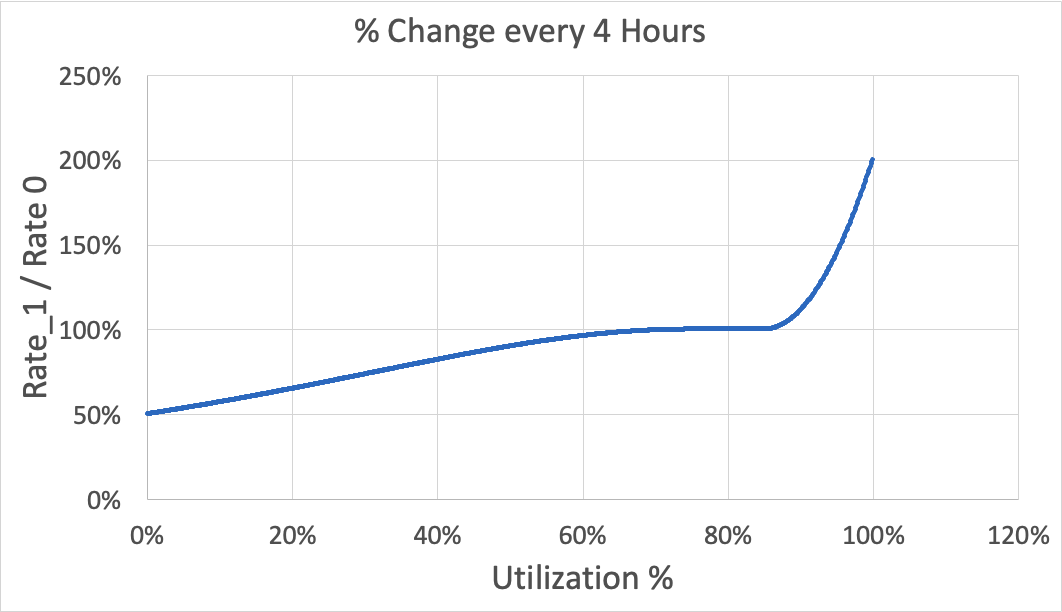

The Time-Weighted Variable Rate Calculator allows the interest rate to float flexibly based on a target ‘healthy’ pool utilization rate and the amount of time that the pool has spent outside of the target range.

*Source, The following graph shows how the interest rate changes when the Interest Rate Half-Life is 4 hours, with a Target Utilization Range of 75% - 85%*